An inflexible protection platform can hinder a provider’s ability to update and launch new products efficiently.

It can also create frustrations for the advisers who rely on these systems.

For example, many platforms enforce a rigid sequence of underwriting questions, forcing advisers to gather all the relevant information from clients before starting the application process.

Additionally, once an underwriting decision is made, most platforms can’t accommodate any further changes—meaning even a minor last-minute change requires restarting the entire process.

With these challenges in mind, Guardian asked us to design and build a scalable end-to-end quote & apply system to accommodate their commercial ambitions and give advisers greater control when submitting business.

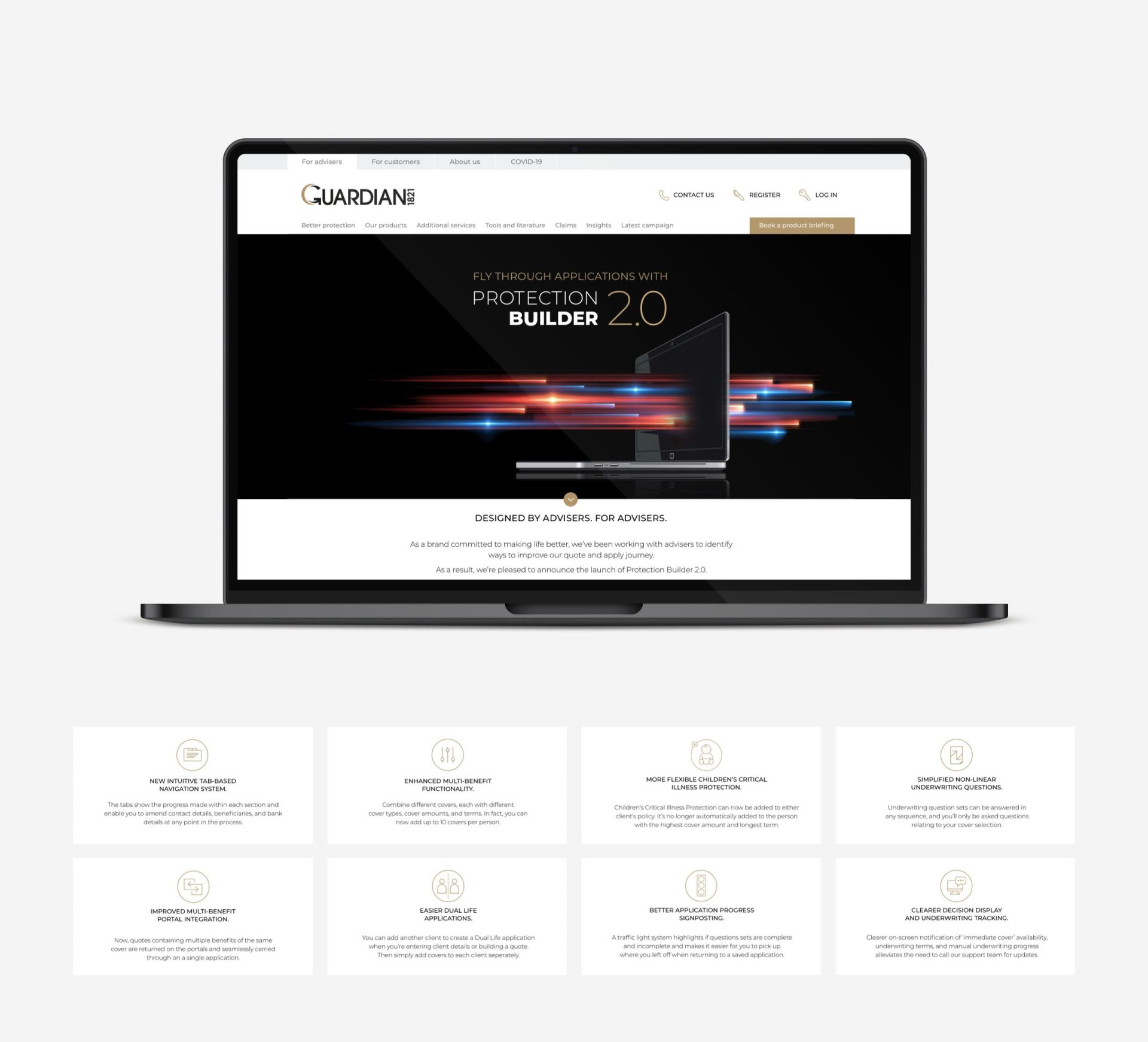

By placing advisers at the centre of the design process through continuous user testing, we developed Protection Builder 2.0 – the second iteration of Guardian’s quote-and-apply platform.

At its core is a market-leading underwriting engine, enhanced by a bespoke user experience that brings Guardian’s unique menu proposition to life. This intuitive design gives advisers greater control and flexibility, streamlining the application process like never before.

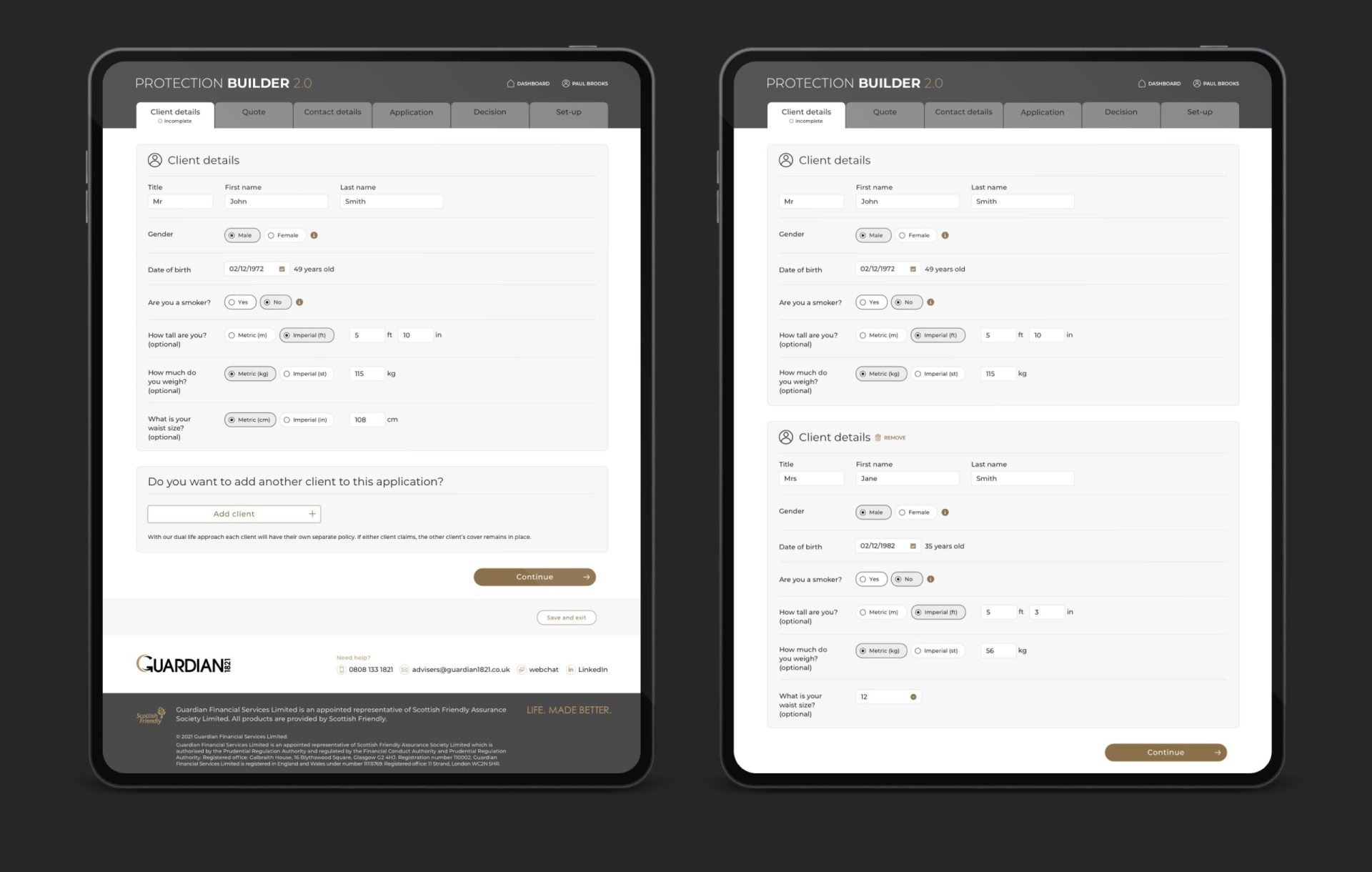

Intuitive tab-based navigation system.

The tabs show the progress made within each section and enable you to amend contact details, beneficiaries, and bank details at any point in the process.

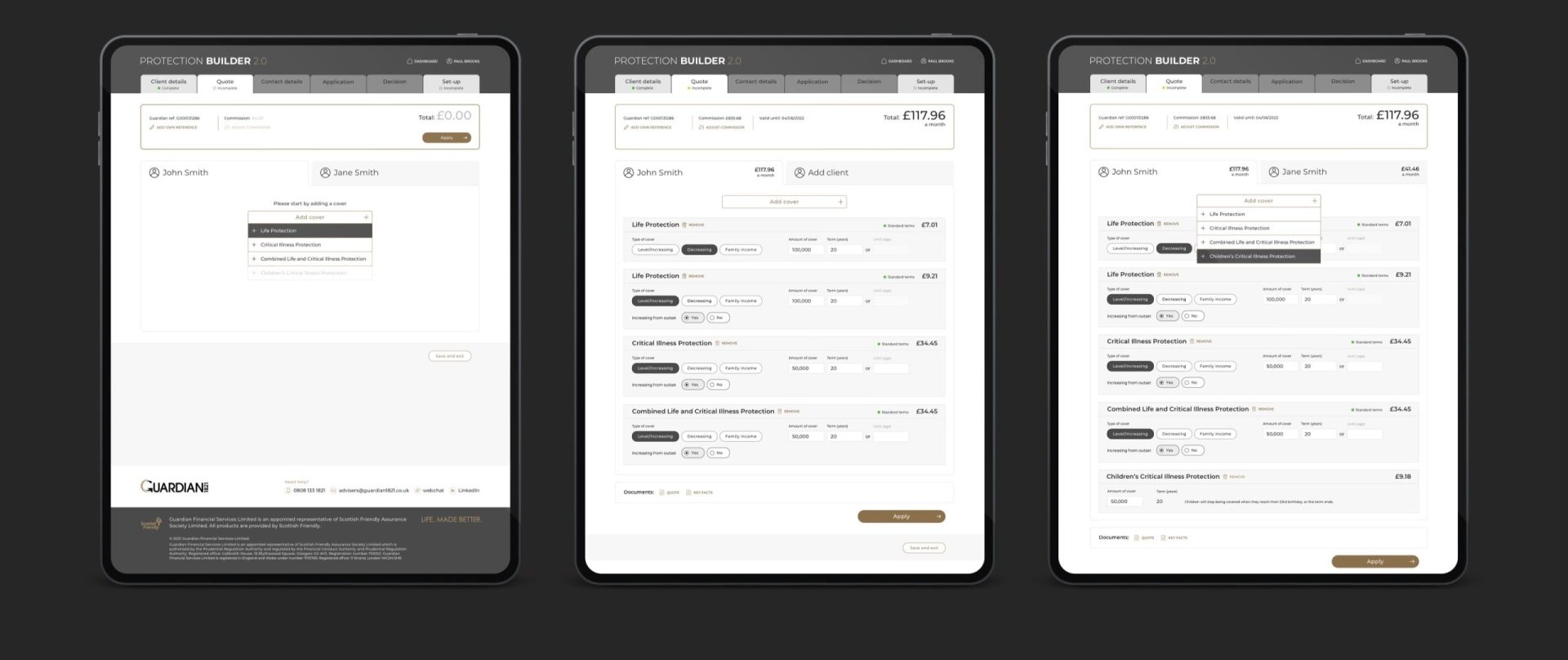

Multi-benefit functionality.

Advisers can combine different covers, each with different cover types, cover amounts, and terms. They can add up to 10 covers per person.

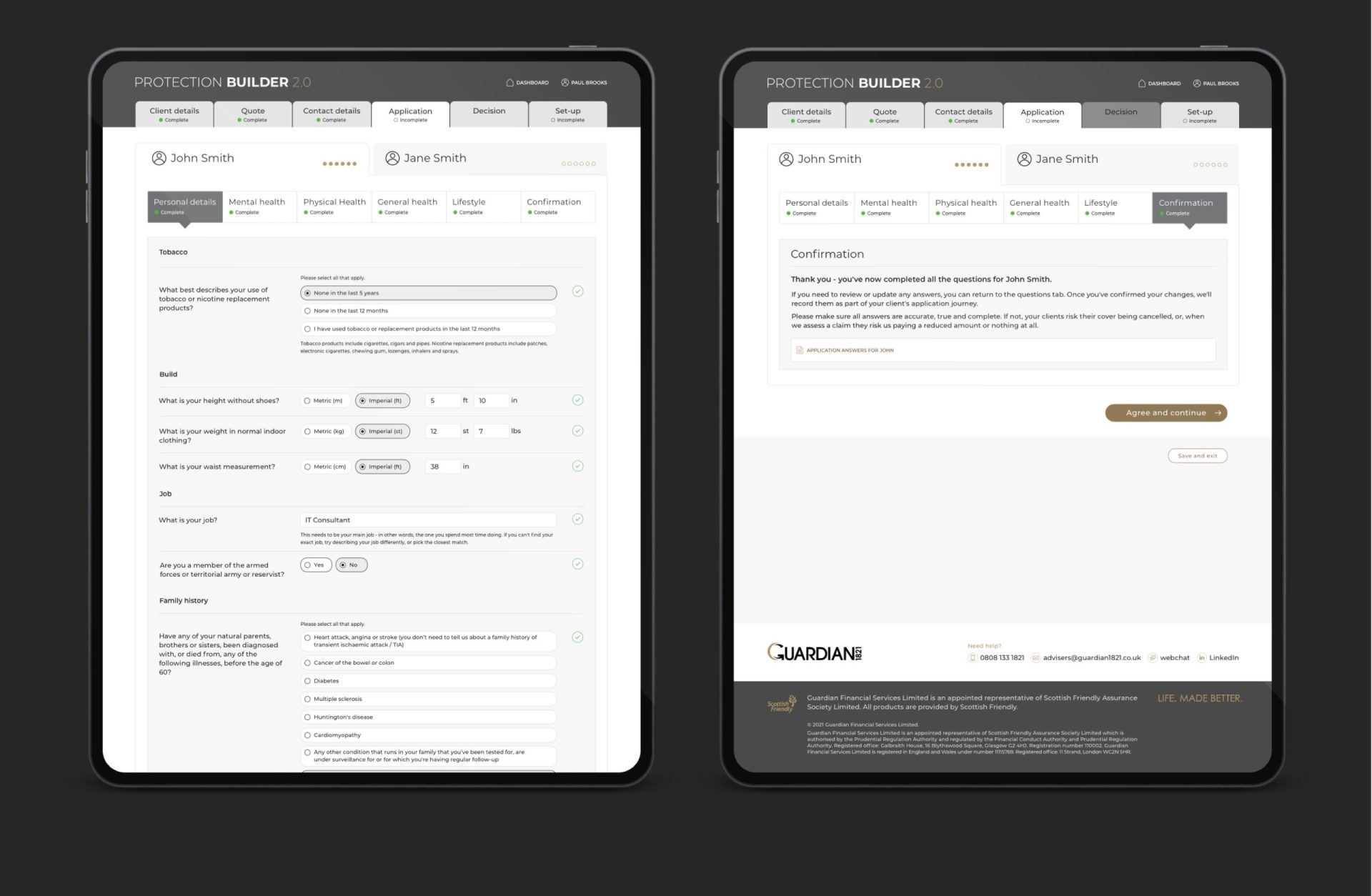

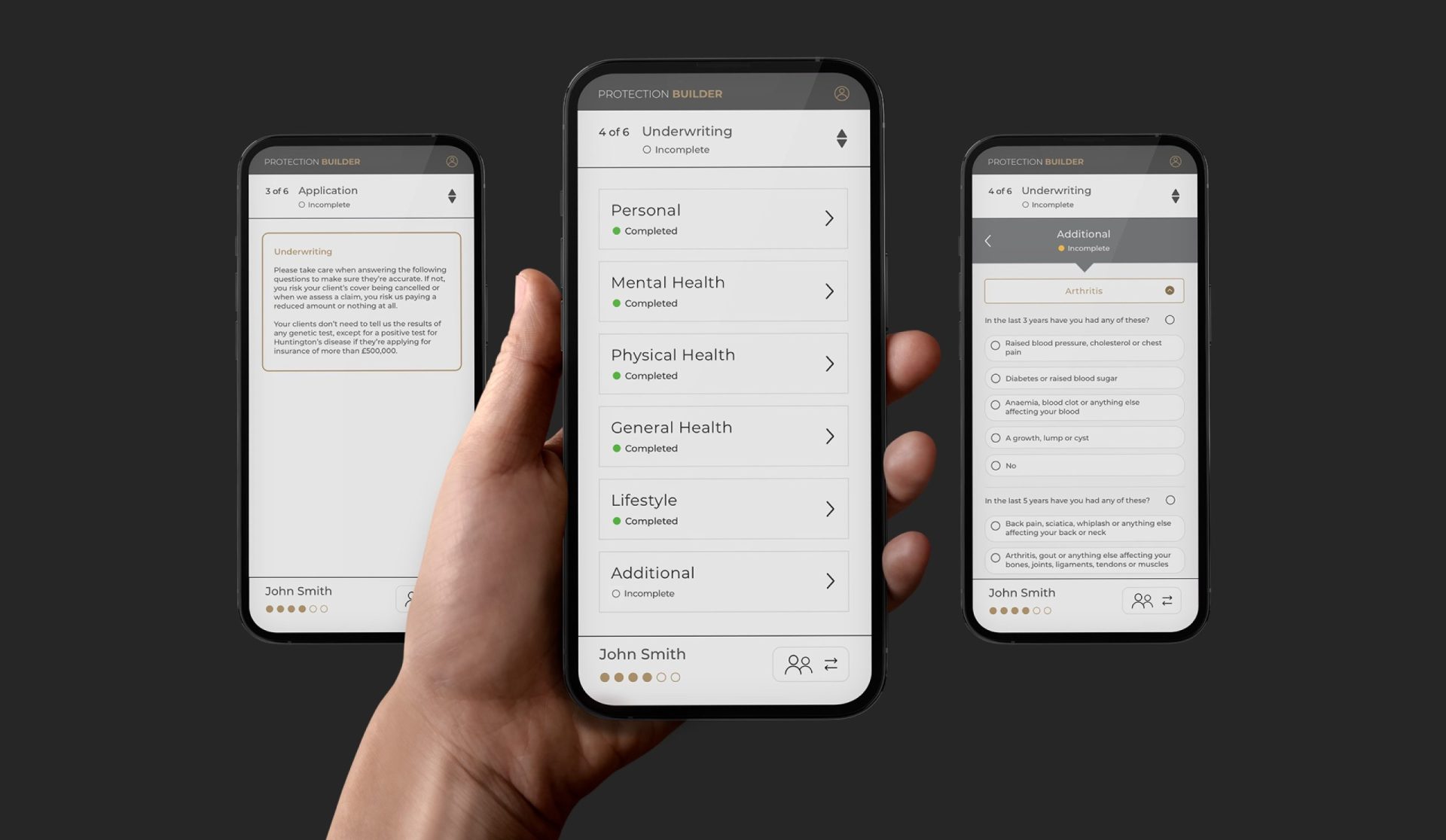

Simplified non-linear underwriting questions.

Underwriting question sets can be answered in any sequence, and you’ll only be asked questions relating to your cover selection

Application progress signposting.

A traffic light system highlights if question sets are complete and incomplete, so advisers can easily pick up where they left off when returning to a saved application.

Clear decision display and underwriting tracking.

Clear on-screen notification of ‘immediate cover’ availability, underwriting terms, and manual underwriting progress alleviates the need to call support team for updates.

Post-decision flexibility.

Advisers can edit and delete individual covers and correct and add underwriting disclosures post-decision

End-customer tested user journey.

The user journey was tested by end-customers and advisers to ensure the system could accommodate delegated underwriting in the future.