A leading UK retail banking group is dedicated to helping its customers invest for a secure retirement and had recently launched an online pension proposition.

However, many people struggle to understand how much income they’ll need in retirement or how much they should contribute each month to achieve their goals.

To address this, and drive engagement with their new pension proposition, the bank asked us to develop a simple yet engaging calculator that would help customers assess whether they’re on track for a comfortable retirement.

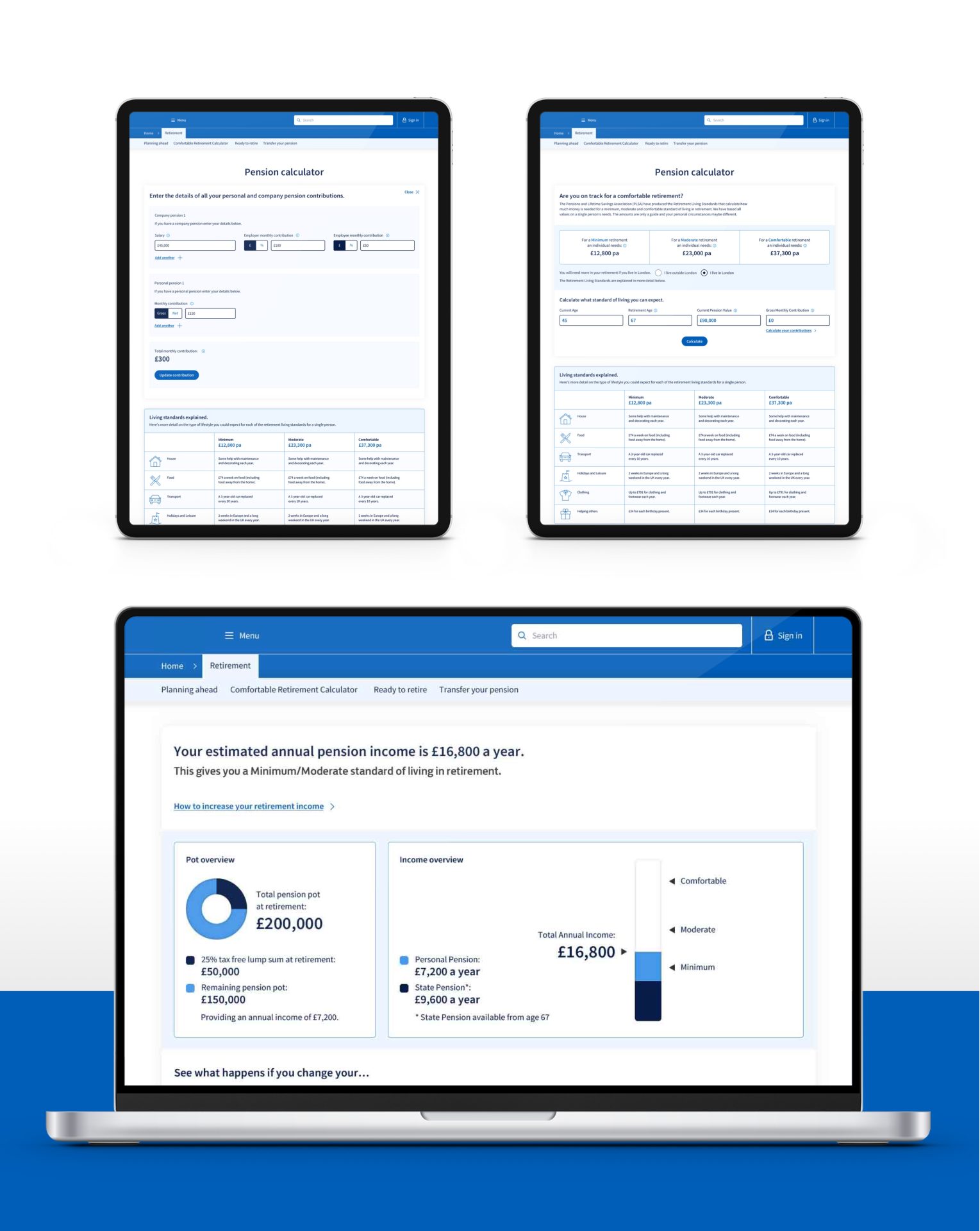

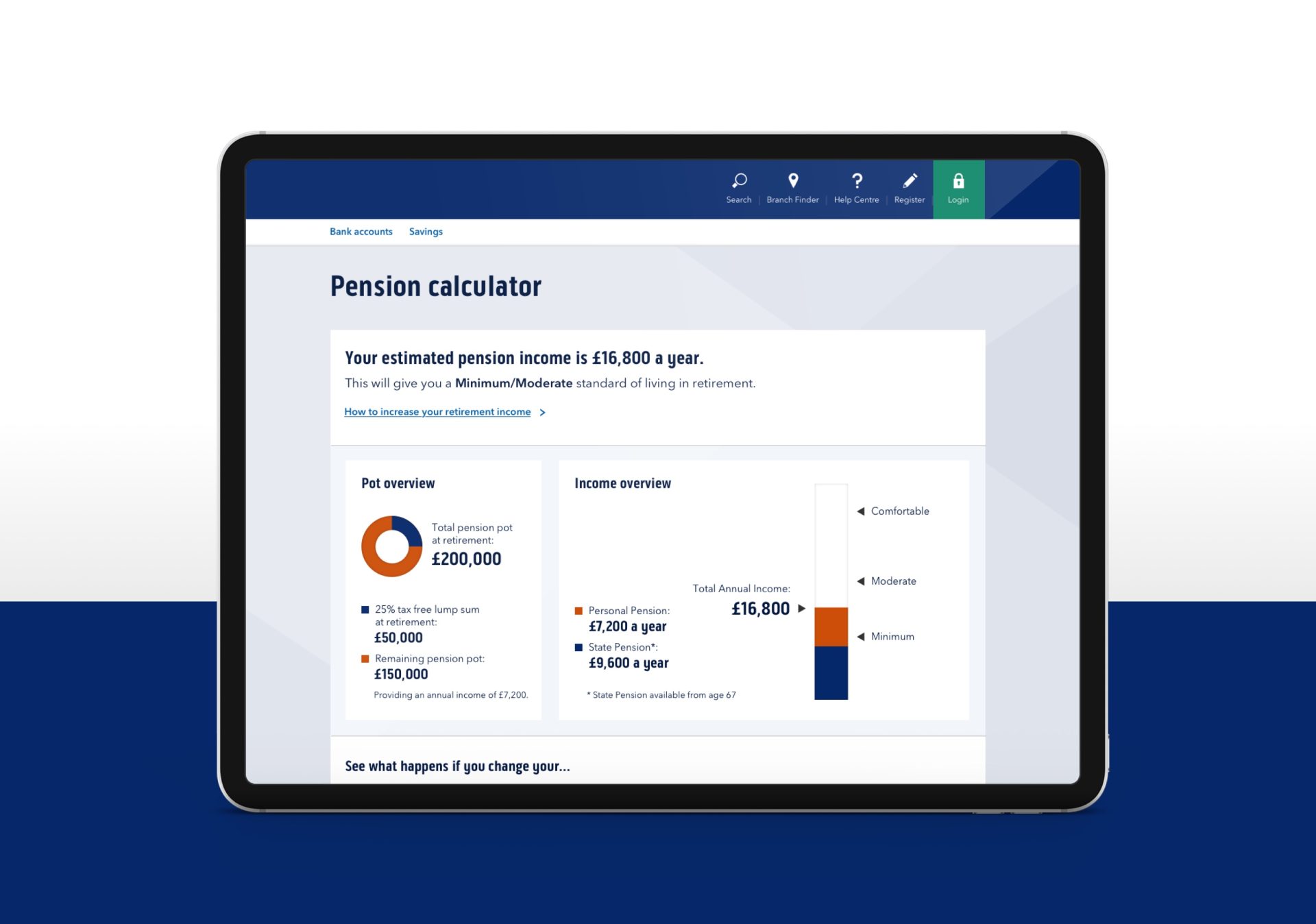

The tool also needed to be designed to work across multiple subsidiary brands.

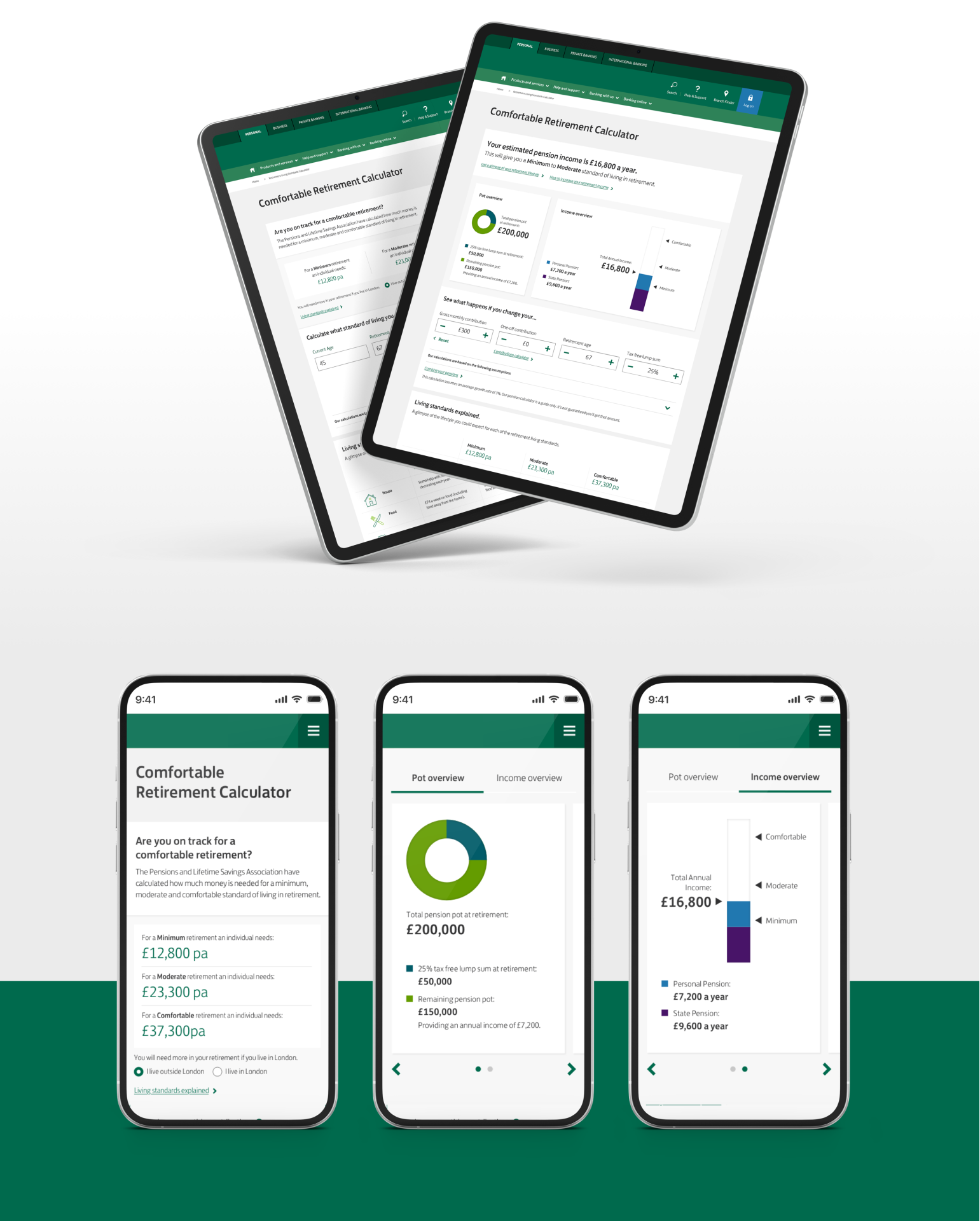

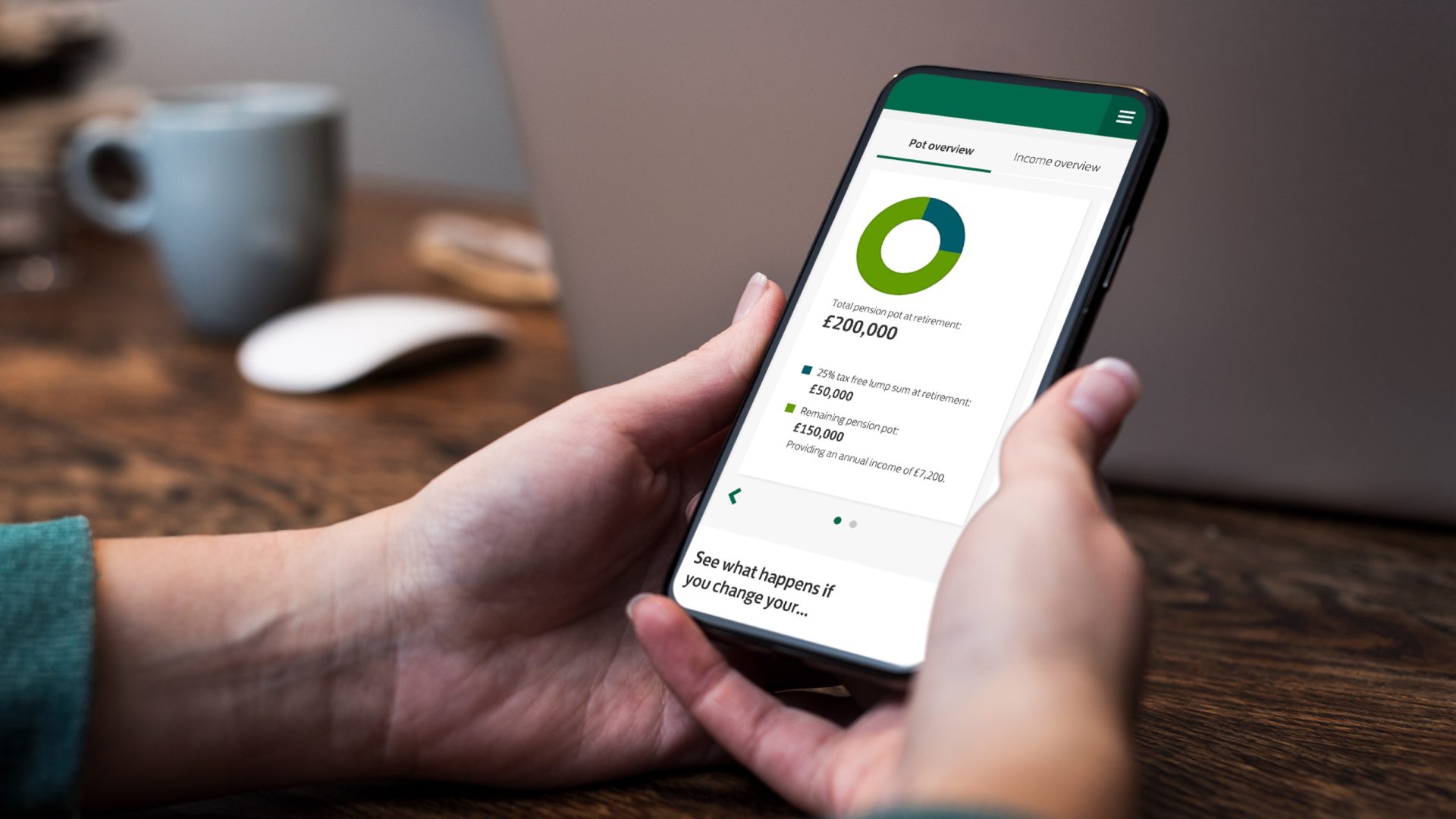

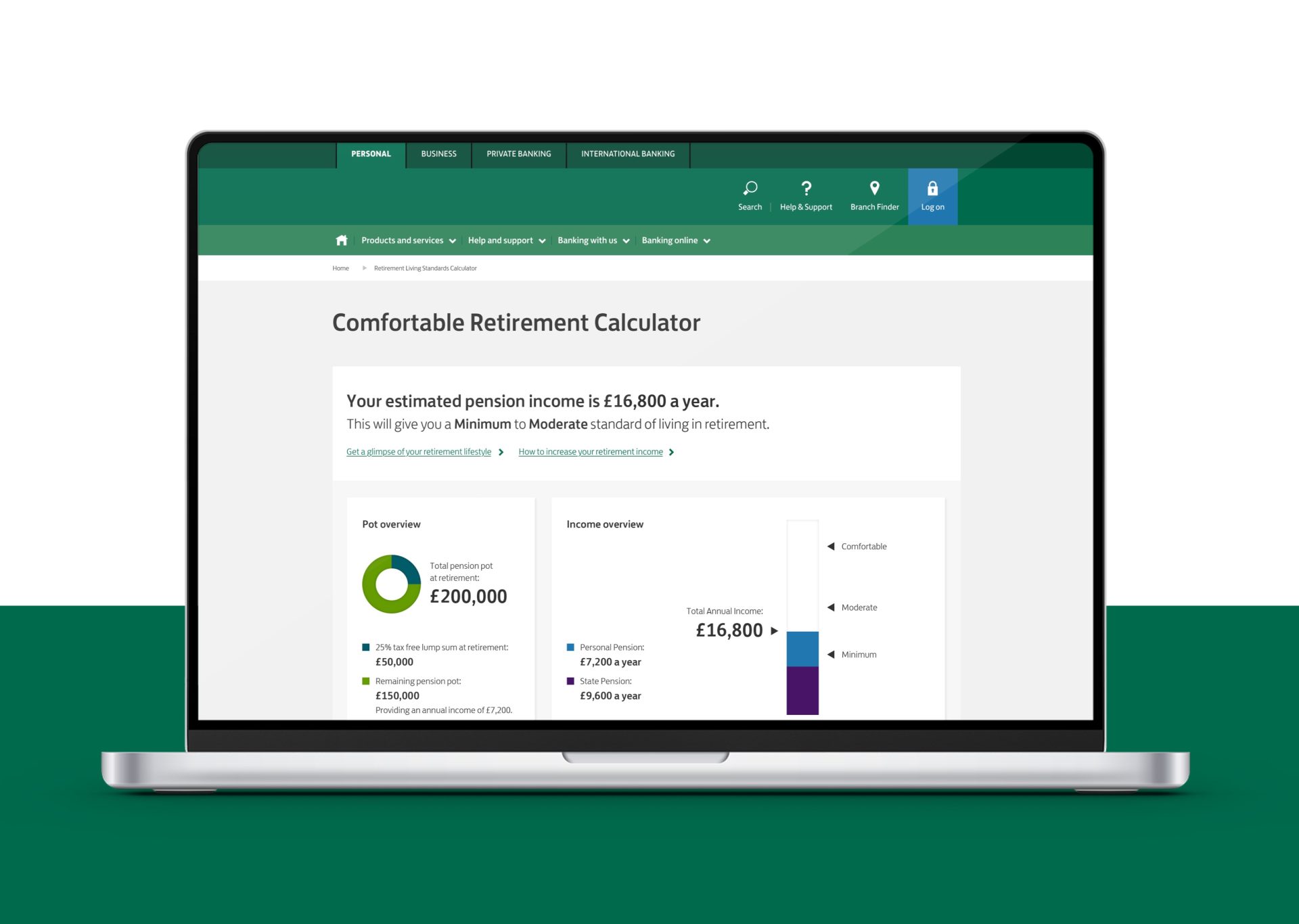

The calculator helps customers estimate the future value of their pension and projected retirement income based on their current pension pot and monthly contributions.

Results are benchmarked against the Pensions and Lifetime Savings Association’s recommendations, showing whether the customer is on track for a minimal, moderate, or comfortable retirement.

Users can then explore how adjusting their monthly contributions, adding lump sums, or changing their retirement age could improve their retirement income.

Designed for seamless use across desktop, tablet, and mobile devices, the calculator can also be easily rebranded for the group’s subsidiary brands.